Recent data breaches, including the massive National Public Data breach, have exposed billions of personal records, highlighting the vulnerability of sensitive information like Social Security numbers. This information is crucial for essential tasks like filing taxes, managing credit, and accessing government benefits, making its exposure a serious threat. This article outlines proactive steps to mitigate the risk of identity theft and fraud, even if your Social Security number has been compromised.

Hackers-know-your-social-security-number-Heres-how-to-stay.png

Hackers-know-your-social-security-number-Heres-how-to-stay.png

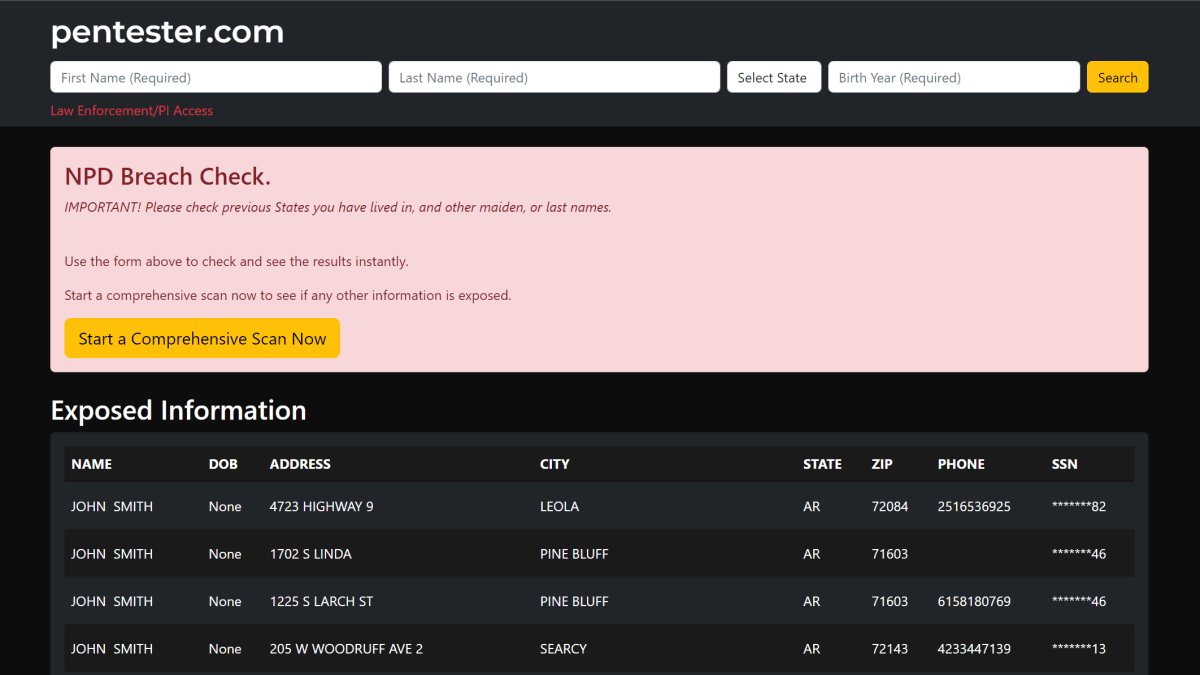

1. Verify Data Exposure

While taking precautionary measures is always advisable, confirming if your information was involved in a breach can provide added motivation. Several vetted websites offer this service without requiring sensitive details:

- NPD Breach Check: npd.pentester.com

- National Public Data Breach Check & Search: npdbreach.com

These resources offer varying levels of detail based on the information you provide. Alternatively, services like Google’s Dark Web Report and paid antivirus subscriptions provide ongoing monitoring. Have I Been Pwned offers data breach notifications, but requires your email address to have been part of the leaked data.

1735661104_929_Hackers-know-your-social-security-number-Heres-how-to-stay.png

1735661104_929_Hackers-know-your-social-security-number-Heres-how-to-stay.png

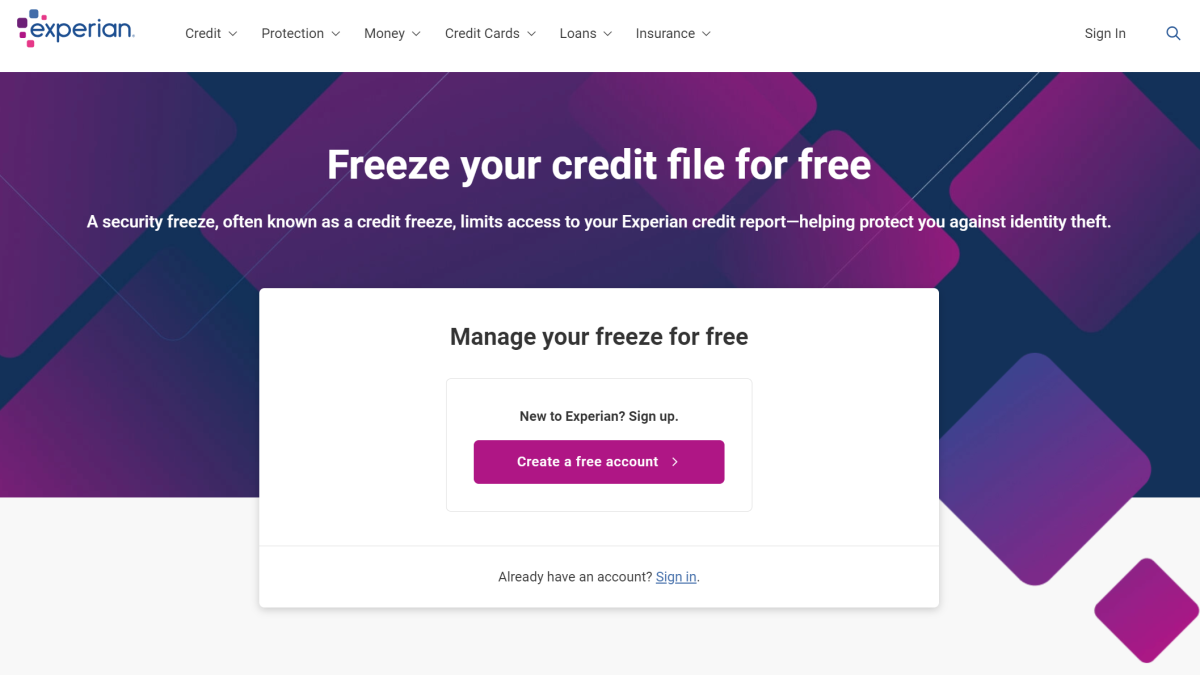

2. Freeze Your Credit Reports

Freezing your credit reports prevents unauthorized individuals from opening credit accounts in your name. This free service must be implemented with each of the major credit bureaus: Equifax, Experian, and TransUnion. For added security, consider freezing your report with Innovis as well. Freezing your credit restricts access to your reports, and you can temporarily lift the freeze when necessary, such as applying for credit, using a provided PIN.

1735661105_287_Hackers-know-your-social-security-number-Heres-how-to-stay.png

1735661105_287_Hackers-know-your-social-security-number-Heres-how-to-stay.png

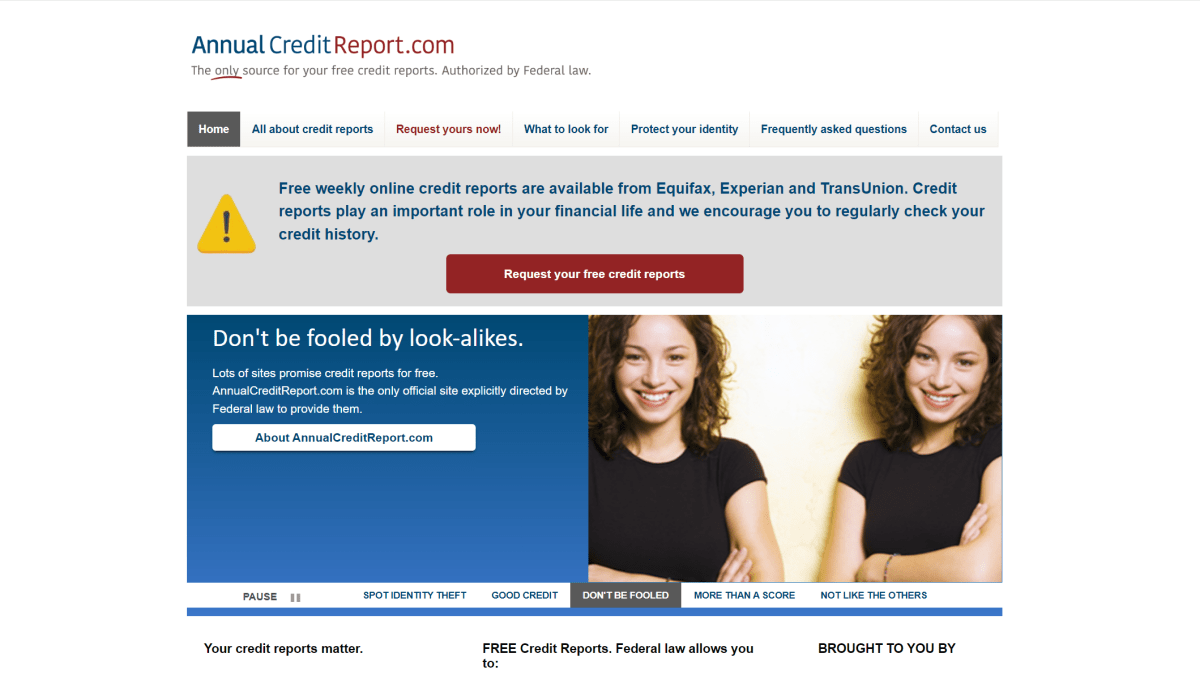

3. Review Your Credit Reports

Regularly reviewing your credit reports allows you to identify and dispute any inaccuracies or signs of fraudulent activity. You can access your reports weekly through AnnualCreditReport.com or request paper copies annually. If you detect identity theft, report it immediately to initiate remediation.

1735661105_283_Hackers-know-your-social-security-number-Heres-how-to-stay.png

1735661105_283_Hackers-know-your-social-security-number-Heres-how-to-stay.png

4. Secure Your Tax Returns with an IP PIN

An Identity Protection PIN (IP PIN) from the IRS can prevent fraudulent tax filings. This six-digit PIN is required for processing any tax return filed under your name. Most taxpayers need a new PIN annually, unless they’ve been victims of tax-related identity theft, in which case the IRS automatically provides a new PIN yearly. Store your IP PIN securely, perhaps in a password manager.

1735661106_22_Hackers-know-your-social-security-number-Heres-how-to-stay.png

1735661106_22_Hackers-know-your-social-security-number-Heres-how-to-stay.png

5. Freeze Your Banking Report with ChexSystems

Protecting your banking information is crucial. ChexSystems maintains records of banking activity, and fraudulent accounts opened in your name can negatively impact your ability to open future accounts. Freezing your ChexSystems report restricts access to this information, and you can temporarily lift the freeze using your assigned PIN when needed, such as opening a new bank account.

By implementing these protective measures, you can significantly reduce the risks associated with data breaches and safeguard your financial well-being.