Generative AI’s ability to create convincing fake news poses a significant threat to financial stability, increasing the risk of bank runs, according to a new UK study. The research, conducted by Say No to Disinfo and Fenimore Harper, highlights the ease with which AI can fabricate stories about bank security flaws or the safety of deposits, potentially triggering widespread panic and mass withdrawals.

European Union

European Union

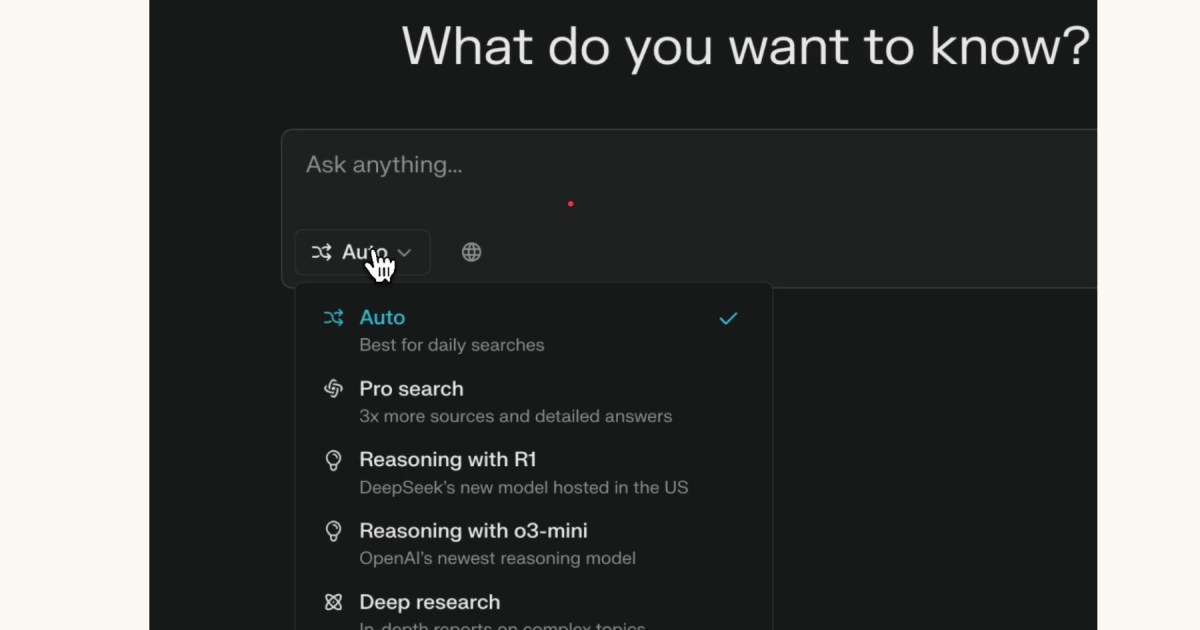

The report emphasizes the growing accessibility and effectiveness of AI-powered disinformation campaigns. The speed and low cost of disseminating fake news through social media, coupled with the instant nature of online banking transactions, creates a volatile environment for financial institutions. The study estimates that a mere $12 investment in social media advertising could yield $1.2 million in fraudulent gains for malicious actors.

This alarming potential necessitates proactive measures from banks and financial institutions. The study recommends implementing robust monitoring systems to detect unusual withdrawal patterns and identify instances where disinformation is influencing customer behavior. Woody Malouf, Revolut’s head of financial crime, acknowledged the potential for such an event, stressing the importance of preparedness within the financial sector, as reported by Reuters.

Despite these concerns, financial institutions remain optimistic about AI’s potential. UK Finance assured Reuters that banks are actively working to manage the risks associated with AI, and regulatory bodies are addressing the potential challenges to financial stability posed by this technology. This comes amidst discussions at the AI Summit in Paris, where industry leaders are exploring the future of AI development and its implications. The summit follows previous calls, such as those by JD Vance, for the US to lead in AI processor development.