The US government is actively exploring strategies to reduce its reliance on Taiwan Semiconductor Manufacturing Co Ltd (TSMC) and bolster domestic semiconductor production, potentially favoring American companies like Intel. TSMC, a global leader in semiconductor manufacturing, currently supplies vital components to numerous US tech giants. This shift aligns with the government’s emphasis on strengthening domestic manufacturing capabilities.

Recent reports suggest the US government has presented TSMC with three proposals to reshape its US presence and contribute to the growth of Intel Foundry. These proposals aim to transition TSMC from an international supplier to a more domestically focused entity.

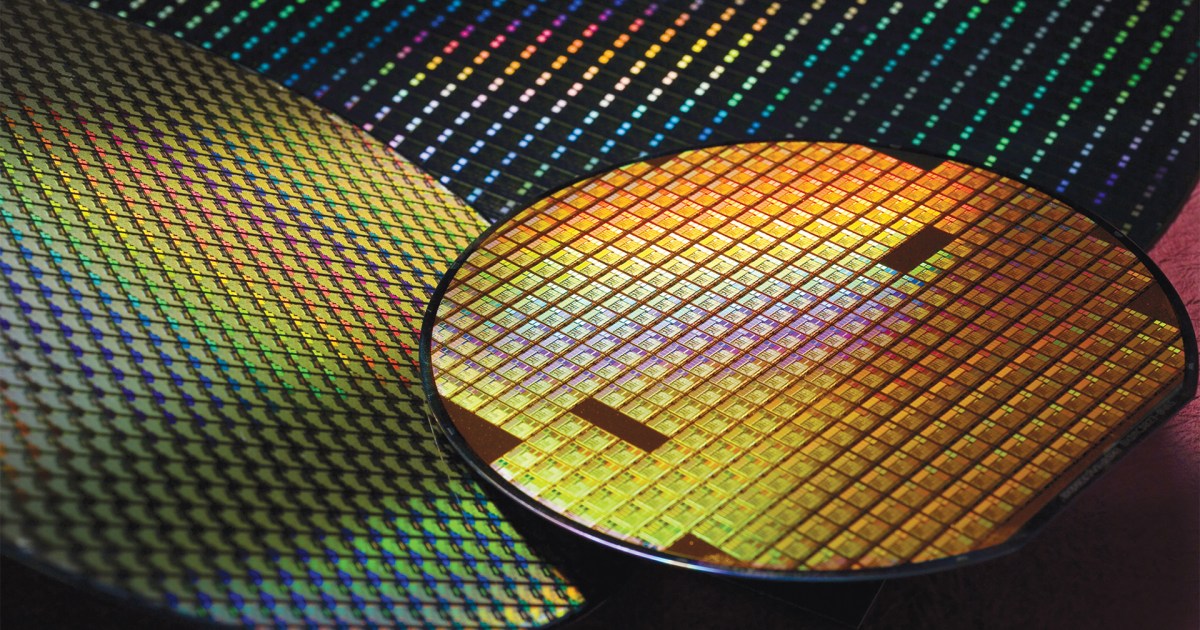

One proposal involves TSMC establishing an advanced packaging facility in the US, integrating wafer manufacturing and backend processing. This would address the reliance on international resources, but TSMC has reportedly expressed concerns regarding labor shortages and potential low profit margins.

A second, more controversial proposal, involves a joint venture between TSMC and Intel Foundry. This would entail financial investment from TSMC and other companies into Intel, potentially involving technology transfer and intellectual property sharing. TSMC reportedly opposes this option, fearing it could displace them from the semiconductor market in favor of Intel. It’s worth noting that TSMC and Intel employ different manufacturing technologies, requiring Intel to develop new processes if it were to adopt TSMC’s role.

The third proposal positions Intel Foundry as the primary supplier for US partners. This option, too, poses a significant threat to TSMC’s market share and industry standing.

These reports have fueled a recent surge in Intel’s stock price. Following Vice President J.D. Vance’s remarks at an AI summit in Paris emphasizing the importance of domestic semiconductor manufacturing, Intel’s shares saw a four-day positive streak. Vance highlighted Intel as a key beneficiary of government plans, given its position as the largest US chip manufacturer.

Speculation surrounding the potential TSMC-Intel joint venture coincides with the ongoing promotion of the US Chips Act. This act aims to fund and facilitate the construction of US-based chip plants.

While Intel Foundry holds the advantage of domestic production, it currently lacks major customers. Despite being separated from Intel’s hardware business, it remains one of the few US-based semiconductor manufacturers.

Adding to the intrigue is the upcoming competition between Intel’s 18a and TSMC’s 2nm manufacturing processes. Early analysis suggests Intel’s 18a may offer superior performance.

While the details remain speculative, these developments place both Intel and TSMC firmly in the spotlight. The future direction of the US semiconductor supply chain will undoubtedly have significant implications for the global tech industry.