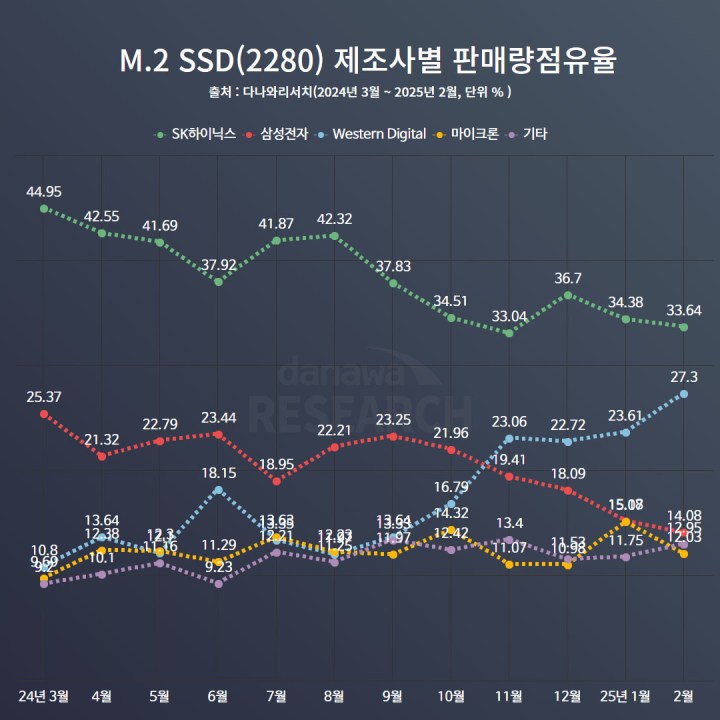

The M.2 SSD market is witnessing a dynamic shift in market share, with Samsung, a long-time leader, experiencing a notable decline. Data from Danawa Research reveals a significant drop in Samsung’s market share, falling from 25.37% in March 2024 to just 14.08% in February 2025. This 11.29% decrease signals a growing competitive landscape, as consumers increasingly explore alternative SSD options offering compelling combinations of performance, price, and reliability.

Western Digital (WD) has emerged as a key beneficiary of this market shift. The company’s market share surged from 10.89% in March 2024 to an impressive 27.3% in February 2025, positioning WD as a major challenger to Samsung’s dominance. This 16.41% increase highlights the success of WD’s SSD portfolio, particularly its high-performance models offered at competitive prices.

M.2 SSD market share from March 2024 to February 2025

M.2 SSD market share from March 2024 to February 2025

While SK Hynix, the initial market leader with 44.95% in March 2024, also experienced a decline, it maintains a strong position. Its market share decreased to 33.64% by February 2025, still representing the largest portion of the market. Though SK Hynix SSDs retain broad appeal, the consistent decline suggests the effectiveness of competitors’ strategies.

Micron has demonstrated consistent market presence, maintaining a share between 12-14% throughout the period. While not experiencing the rapid growth of WD, Micron has secured a solid segment of the SSD market, attracting users seeking a balance of reliability and value.

Several factors contribute to the intensifying competition in the SSD market. Aggressive pricing strategies, advancements in PCIe 4.0 and 5.0 technologies, and evolving consumer preferences for larger-capacity drives are key drivers. The future remains to be seen whether Samsung will regain lost ground or if the market will continue to favor competitors like WD and SK Hynix. Regardless, the SSD landscape is undergoing a significant transformation, offering consumers an expanding range of choices.

The Danawa Research report also highlights the growing adoption of PCIe 4.0 SSDs, accounting for 69.29% of sales in February 2025. With increasing support for PCIe 4.0 from motherboards and gaming consoles, users are prioritizing faster speeds. Consequently, PCIe 3.0 SSDs have seen a decline to 27.56% of sales. This trend indicates that despite their affordability, older-generation drives are losing traction as consumers seek enhanced performance for gaming and professional applications.

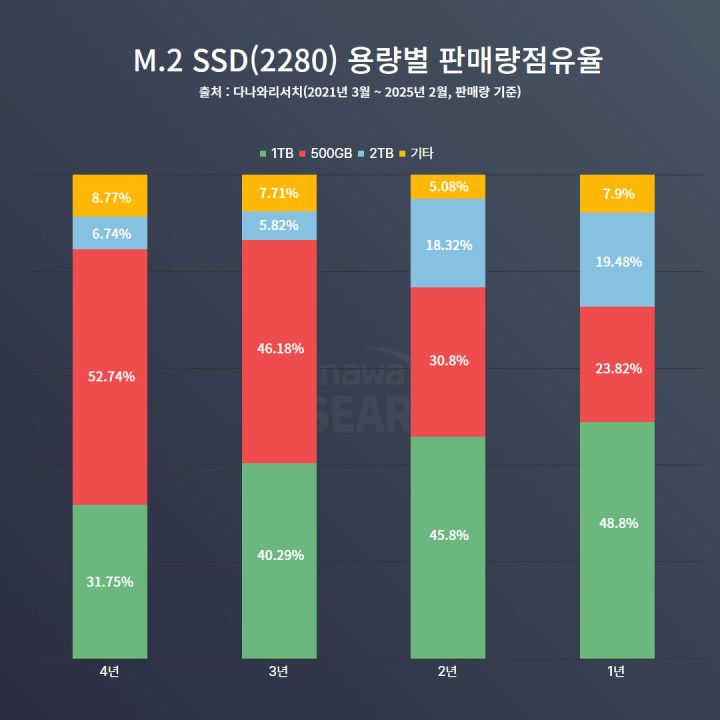

M.2 SSD capacity trends from March 2024 to February 2025

M.2 SSD capacity trends from March 2024 to February 2025

A significant shift in preferred M.2 SSD capacities is also evident, with 1TB becoming the new standard. While 500GB SSDs held a dominant 52.74% share in 2021, their popularity has steadily decreased to 23.82% by early 2025. Conversely, 1TB SSDs have experienced a surge, rising from 31.75% to 48.8%, establishing them as the preferred choice for most users.

Furthermore, 2TB SSDs have gained substantial traction, increasing from a modest 6.74% share in 2021 to 19.48% in 2025. This growth reflects the increasing storage demands driven by gaming, professional workloads, and large application installations. As SSD prices continue to decline and file sizes increase, consumers are increasingly opting for larger storage capacities.