The Chinese AI smartphone market reveals a significant challenge for Apple as Huawei and Xiaomi solidify their dominance. New data highlights the uphill battle Apple faces in introducing its AI platform, Apple Intelligence, to this crucial market. Delays in launching the platform could cost Apple valuable market share in an increasingly competitive landscape.

Currently, Huawei commands 34.8% of the Chinese AI smartphone market, while Xiaomi holds a strong 26.9%, according to recent reports. Combined, these two mobile giants control a staggering 61.7% of the market, dwarfing competitors like Vivo, which holds an 11.6% share. Apple is conspicuously absent from these figures.

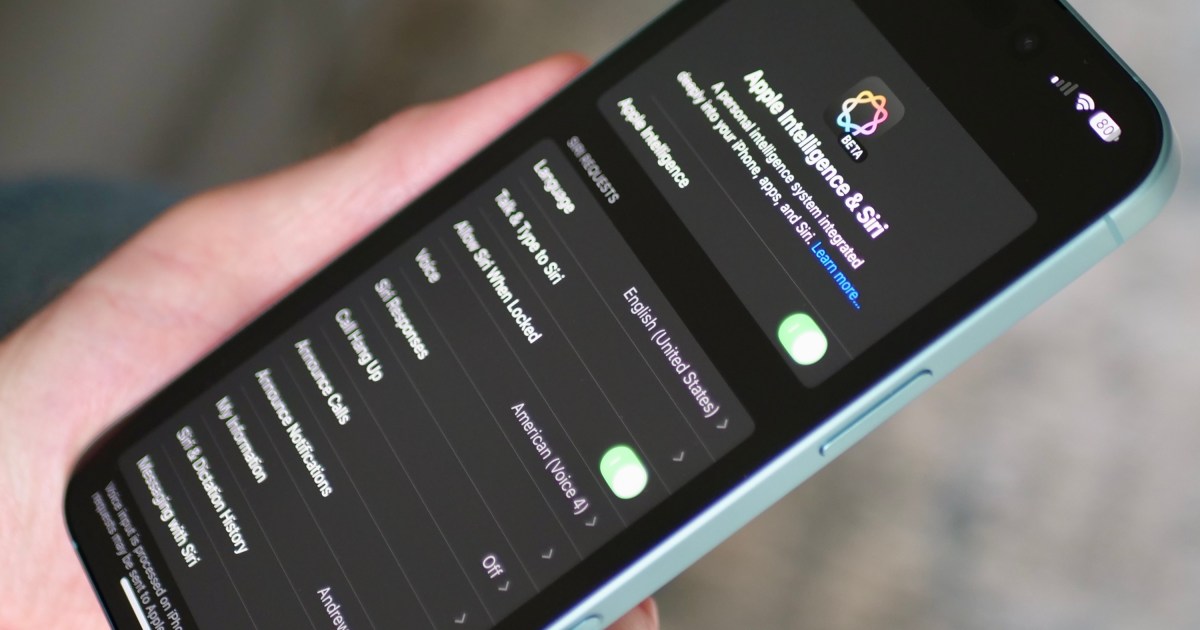

Apple unveiled its Apple Intelligence AI platform in June and further elaborated on its features with the iPhone 16 series launch in September. However, the official release didn’t occur until October 2024 with iOS 18.1. Even now, certain functionalities remain in beta testing, and not all regions have access to even the basic features of Apple Intelligence. China is notably among these excluded regions, primarily due to regulatory hurdles.

Apple Intelligence on iPhone 15 Pro.

Apple Intelligence on iPhone 15 Pro.

Launching generative AI products in China mandates government approval, requiring Apple to disclose extensive information regarding its AI’s inner workings, including training methodologies and security assessments. The integration of ChatGPT contributions into Apple Intelligence poses another challenge, as OpenAI has restricted access to its software within China.

This predicament presents Apple with a difficult choice: either abandon its largest overseas market or develop a separate, censored version of its AI assistant. Market share data clearly demonstrates how competitors leverage AI to boost sales, indicating a strong consumer demand for this technology.

Chinese consumers expect premium smartphones to include cutting-edge AI capabilities and may be reluctant to invest heavily in devices lacking these features. Reports indicate that Samsung has collaborated with Baidu and Meitu for certain Galaxy AI functionalities, a strategy Apple might consider to navigate China’s stringent AI regulations.

A graph showing market share of AI smartphones in China.

A graph showing market share of AI smartphones in China.

In late October, Apple CEO Tim Cook visited China and met with the head of the Ministry of Industry and Information Technology. While the meeting’s agenda remains undisclosed, speculation surrounds whether the release of Apple Intelligence in China was a topic of discussion.

Apple maintains its second-place position in overall smartphone shipments in China, with the iPhone 16 mirroring the iPhone 15’s performance. However, recent research reveals a year-over-year decline for Apple, while competitors like Huawei, Xiaomi, and market leader Vivo have experienced significant growth. Addressing the Apple Intelligence challenge in China is crucial for Apple to regain momentum in this vital market.

In conclusion, Apple’s delayed entry into the Chinese AI smartphone market presents a significant hurdle for the company. The dominance of Huawei and Xiaomi underscores the urgency for Apple to navigate regulatory obstacles and introduce a competitive AI solution. Failure to do so could result in further market share erosion and hinder Apple’s growth in this crucial region.