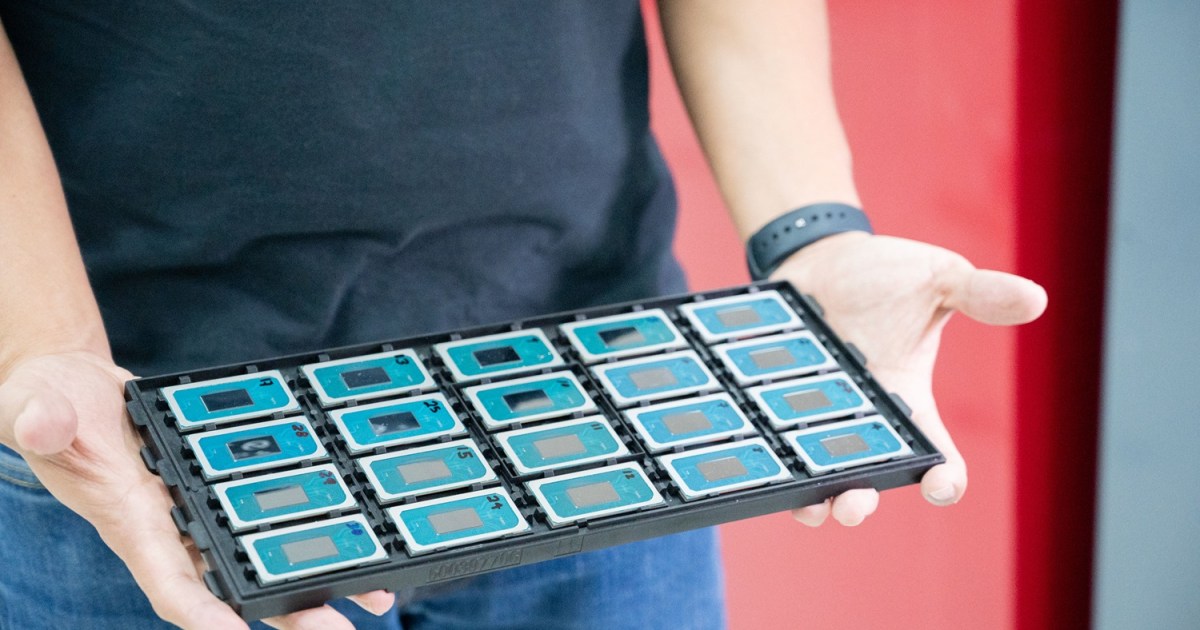

The US government is reportedly encouraging Intel to explore a potential merger with a rival, such as AMD or Marvell, due to the company’s significant financial challenges. This news comes as Intel announced a staggering $16.6 billion loss in the third quarter of 2024, with its net profit margin plummeting by over 6,000% year-over-year. The government considers Intel too crucial to the US semiconductor industry to fail and is reportedly engaging in precautionary talks with the company to explore recovery options.

Potential Merger Scenarios and the CHIPS Act

The proposed merger would primarily involve Intel’s chip design business, leaving its foundry operations untouched. This distinction is important in the context of the CHIPS Act, which has earmarked nearly $30 billion in subsidies for Intel, primarily to bolster its domestic manufacturing capabilities. Despite the legislation passing in 2022, Intel has yet to receive any funds due to its failure to provide the government with sufficient financial details demonstrating a viable plan for utilizing the subsidies.

The US government’s concern stems from the strategic importance of Intel’s manufacturing arm in the global semiconductor landscape, particularly in light of competition from companies like Taiwan’s TSMC and the burgeoning semiconductor industry in mainland China. A merger with a competitor like AMD, while seemingly counterintuitive, could provide Intel with the financial stability needed to focus on its advanced manufacturing processes and fulfill existing contracts with key clients like Microsoft and the US Department of Defense.

Intel’s Manufacturing Focus and Future Challenges

Intel’s future hinges on its ability to deliver on its advanced manufacturing roadmap, especially its 18A node, which has secured significant contracts. Earlier this year, Intel cancelled its 20A node to concentrate resources on 18A, highlighting the company’s commitment to this technology. However, the company’s financial woes raise questions about its ability to invest in and execute its ambitious manufacturing plans.

The company has also explored the possibility of separating its design and manufacturing businesses, a move that could potentially attract investment and streamline operations. If AMD were to acquire Intel’s design division, the CHIPS Act funding could be directed solely towards Intel’s manufacturing efforts, aligning with the government’s focus on strengthening domestic chip production.

Conclusion: A Critical Juncture for Intel

Intel’s current financial predicament presents a critical juncture for the company and the US semiconductor industry. While a merger with a competitor like AMD might seem unconventional, it could be a necessary step to stabilize Intel’s finances and allow it to focus on its crucial manufacturing capabilities. The ongoing discussions with the US government underscore the importance of Intel’s role in the global tech landscape and the need for a viable long-term strategy to ensure its continued success.