Achieving financial independence (FI) requires careful spending, diligent saving, and strategic investing. In today’s digital landscape, a robust budgeting app can be a powerful tool on this journey. I’ve spent years exploring, testing, and analyzing numerous budgeting apps to optimize my own path to FI. While each app has its strengths, some stand out as particularly valuable for those seeking financial freedom.

The “best” app is subjective and depends on individual needs. However, based on my extensive experience, certain apps excel in their features, user-friendliness, and ability to empower users to take control of their finances with FI in mind.

Here are my top recommendations, categorized by their strengths and ideal user profiles:

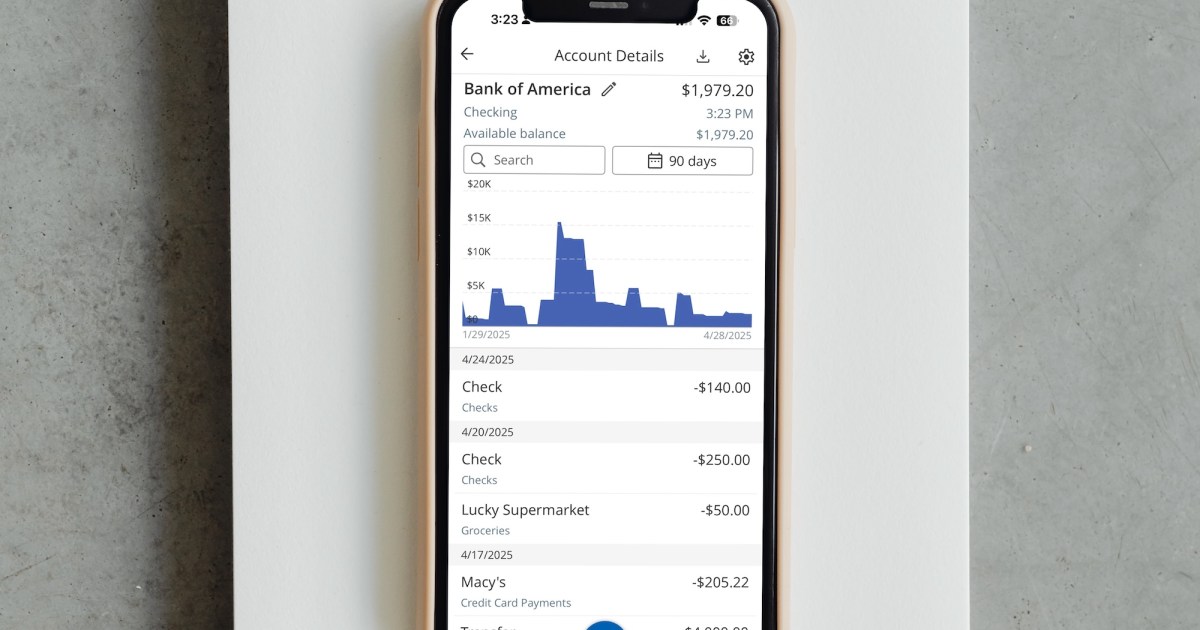

Data-Driven Optimization with YNAB

YNAB all apps.

YNAB all apps.

YNAB (You Need A Budget) is more than a budgeting app; it’s a financial philosophy. Based on four rules – give every dollar a job, embrace your true expenses, roll with the punches, and age your money – YNAB promotes intentional spending.

- Granular Control: Every dollar is assigned a category, eliminating mindless spending and highlighting areas for savings.

- Proactive Budgeting: YNAB encourages budgeting for irregular expenses (car maintenance, holiday gifts) to prevent financial surprises.

- Money Metric Feature: Tracks how long your money has been in your accounts, measuring financial stability and progress.

While powerful, YNAB’s methodology has a steeper learning curve. However, their comprehensive resources make it worthwhile.

Ideal for: Detail-oriented individuals who desire a proactive budgeting approach and precise tracking of their finances. YNAB is a game-changer for those serious about optimizing every dollar for FI.

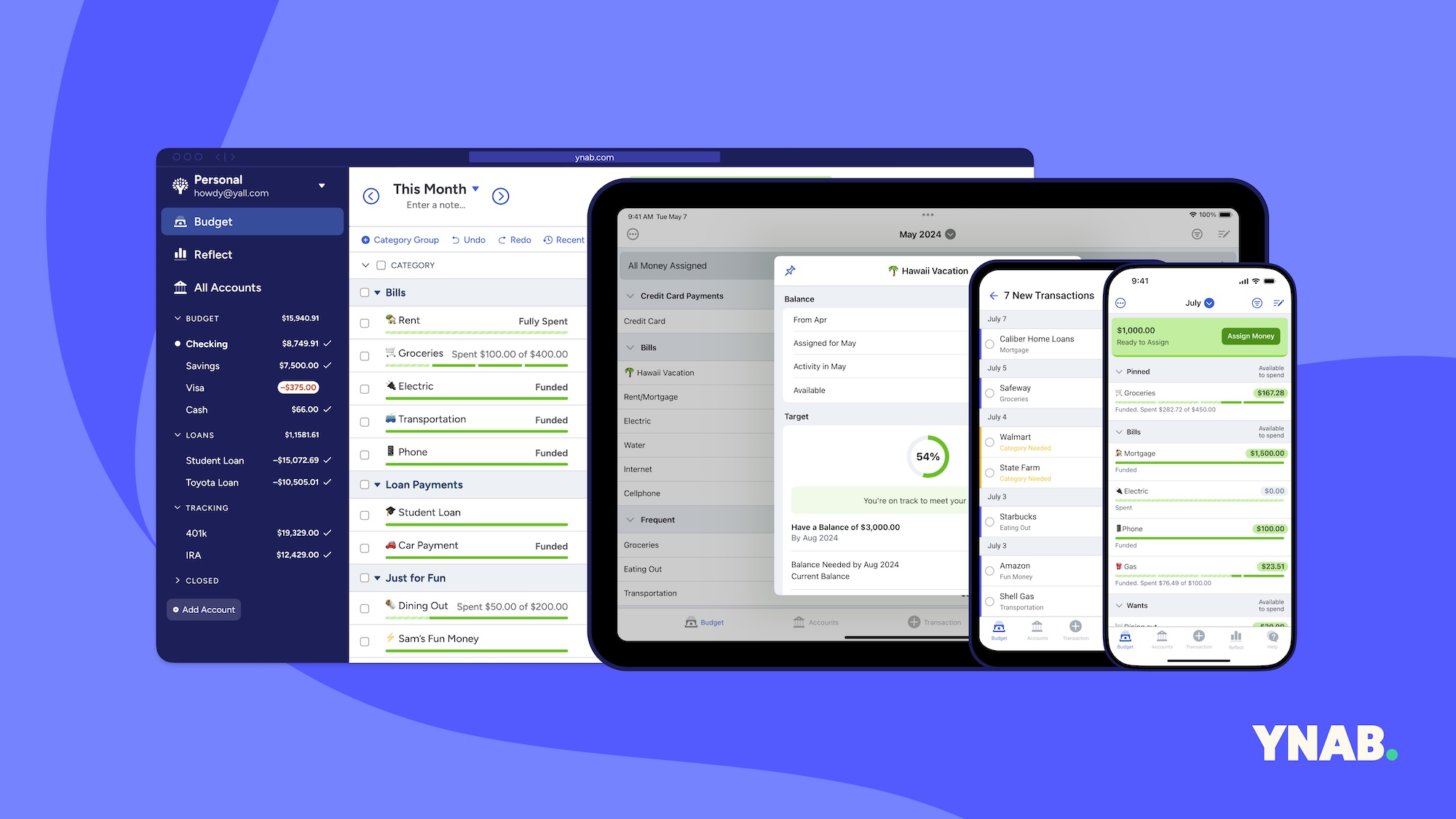

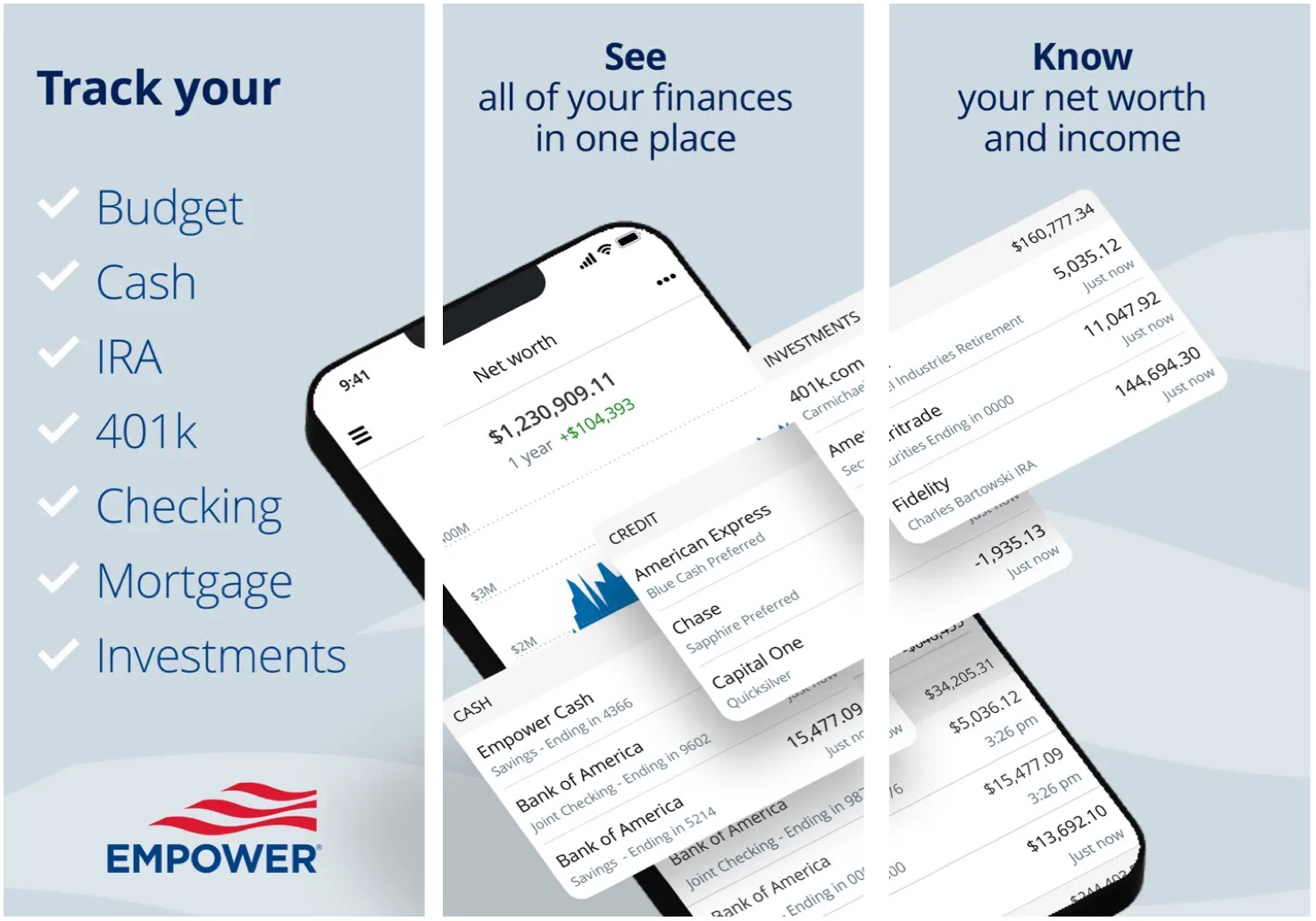

Visual Planning with Empower

Empower app.

Empower app.

Empower Personal Dashboard distinguishes itself with its investment-focused approach, integrating budgeting tools seamlessly. Its intuitive interface emphasizes net worth and investment performance, making it ideal for those building wealth.

- Investment Insights: Analyze asset allocation, performance metrics, and fees to optimize investment strategies for long-term FI.

- Net Worth Tracking: A visually engaging dashboard monitors financial progress, highlighting the relationship between spending, savings, and investments.

- Retirement Planning: Sophisticated calculators project future financial situations based on current savings and investments.

- Free Version Availability: Access valuable financial planning tools and insights without cost.

Ideal for: Active investors seeking a platform that combines budgeting with investment tracking and retirement planning. Empower is excellent for visualizing progress towards FI through net worth growth.

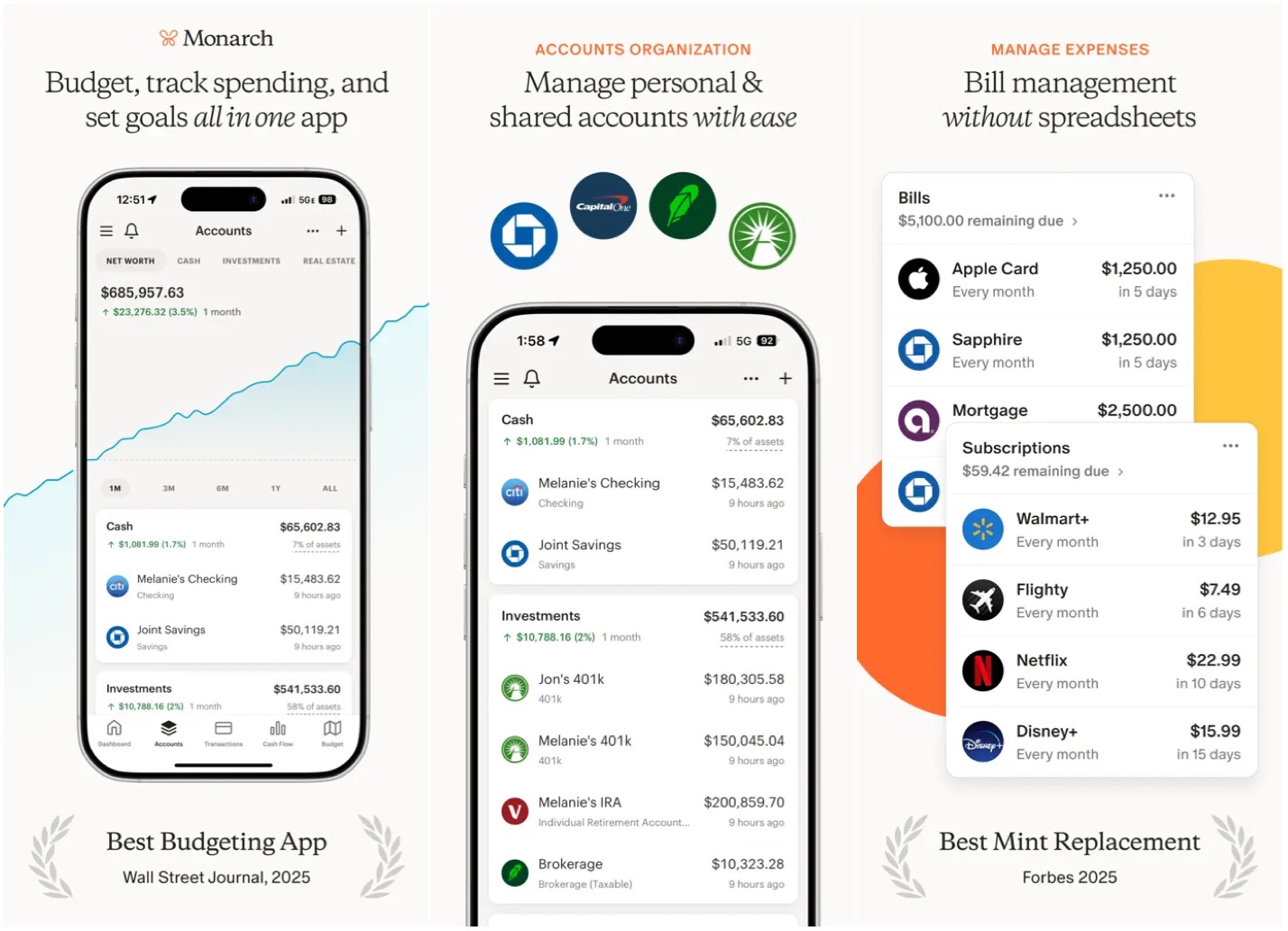

Holistic Financial Planning with Monarch

Monarch Money app.

Monarch Money app.

Monarch Money is a comprehensive personal finance management tool. Connecting various accounts (banking, credit cards, investments) provides a holistic financial overview.

- Robust Budgeting Tools: Automated expense tracking and categorization simplify monitoring spending habits and identifying savings opportunities.

- Investment Monitoring: Gain insights into portfolio performance and asset allocation.

- Household Collaboration: Facilitates shared financial management for families.

However, Monarch Money is subscription-based, lacks a free version and integrated credit score monitoring, and may experience occasional syncing issues. It focuses on tracking and analysis, not direct transactions.

Ideal for: Individuals and couples seeking a comprehensive, collaborative financial management approach. Monarch is a central hub for tracking all aspects of financial life.

Other Notable Budgeting Apps

Beyond the top three, these apps offer unique features:

- PocketGuard: Known for its clean interface and “in my pocket” disposable income tracking. Ideal for beginners.

- EveryDollar: Based on Dave Ramsey’s zero-based budgeting philosophy. Offers manual transaction tracking and premium features.

- Copilot Money: An Apple-exclusive app with AI-powered transaction categorization.

Choosing Your FI Budgeting App

Selecting the right app is crucial. Consider your budgeting style, focus area, technical comfort, and budget. The best app is the one you’ll consistently use. Experiment with free trials and find the app that empowers you to take control of your finances and achieve your financial independence goals.